The smart Trick of Feie Calculator That Nobody is Discussing

Wiki Article

The Only Guide to Feie Calculator

Table of ContentsSome Known Incorrect Statements About Feie Calculator The Single Strategy To Use For Feie CalculatorThe 5-Second Trick For Feie CalculatorThe 8-Minute Rule for Feie CalculatorFeie Calculator Can Be Fun For AnyoneNot known Details About Feie Calculator Feie Calculator - Truths

If he 'd frequently taken a trip, he would certainly rather finish Part III, noting the 12-month period he satisfied the Physical Presence Examination and his travel background. Action 3: Coverage Foreign Revenue (Component IV): Mark earned 4,500 per month (54,000 annually).Mark determines the exchange rate (e.g., 1 EUR = 1.10 USD) and transforms his wage (54,000 1.10 = $59,400). Since he resided in Germany all year, the portion of time he stayed abroad during the tax is 100% and he enters $59,400 as his FEIE. Ultimately, Mark reports total wages on his Type 1040 and gets in the FEIE as an adverse amount on Schedule 1, Line 8d, lowering his taxed earnings.

Selecting the FEIE when it's not the most effective alternative: The FEIE might not be perfect if you have a high unearned income, earn even more than the exemption restriction, or live in a high-tax nation where the Foreign Tax Obligation Credit History (FTC) might be extra useful. The Foreign Tax Obligation Credit Score (FTC) is a tax reduction technique frequently made use of along with the FEIE.

Some Known Questions About Feie Calculator.

deportees to offset their united state tax obligation financial debt with foreign earnings taxes paid on a dollar-for-dollar decrease basis. This suggests that in high-tax countries, the FTC can usually get rid of U.S. tax financial obligation entirely. Nevertheless, the FTC has limitations on qualified tax obligations and the optimum insurance claim quantity: Eligible tax obligations: Only income taxes (or tax obligations instead of revenue tax obligations) paid to international governments are eligible.tax obligation obligation on your foreign revenue. If the foreign taxes you paid exceed this limitation, the excess international tax obligation can generally be continued for approximately 10 years or returned one year (through an amended return). Maintaining exact records of international earnings and taxes paid is for that reason important to computing the right FTC and preserving tax obligation compliance.

expatriates to decrease their tax responsibilities. As an example, if an U.S. taxpayer has $250,000 in foreign-earned revenue, they can leave out as much as $130,000 using the FEIE (2025 ). The continuing to be $120,000 may after that go through taxes, but the U.S. taxpayer can possibly use the Foreign Tax Credit scores to balance out the tax obligations paid to the foreign country.

A Biased View of Feie Calculator

First, he marketed his U.S. home to develop his intent to live abroad permanently and obtained a Mexican residency visa with his other half to assist satisfy the Bona Fide Residency Examination. Additionally, Neil protected a lasting residential or commercial property lease in Mexico, with strategies to ultimately purchase a residential property. "I presently have a six-month lease on a house in Mexico that I can expand an additional six months, with the objective to acquire a home down there." Neil points out that purchasing building abroad can be testing without first experiencing the place."It's something that individuals require to be actually diligent regarding," he states, and recommends deportees to be careful of common errors, such as overstaying in the U.S.

Neil is careful to stress to U.S. tax united state tax obligation "I'm not conducting any carrying out any kind of Service. The United state is one of the few nations that taxes its people regardless of where they live, implying that also if an expat has no income from United state

The Best Guide To Feie Calculator

tax return. "The Foreign Tax Credit scores enables people functioning in high-tax countries like the UK to counter their U.S. tax obligation liability by the quantity they have actually currently paid in tax obligations abroad," says Lewis.The possibility of reduced living prices can be alluring, yet it often includes trade-offs that aren't quickly apparent - https://www.40billion.com/profile/879494225. Housing, as an example, can be a lot more affordable in some nations, however this can imply compromising on facilities, safety and security, or access to trusted utilities and solutions. Low-cost homes may be located in locations with irregular internet, restricted public transport, or unstable healthcare facilitiesfactors that can significantly affect your everyday life

Below are a few of the most often asked inquiries concerning the FEIE and various other exemptions The International Earned Income Exclusion (FEIE) permits U.S. taxpayers to leave out as much as $130,000 of foreign-earned revenue from government earnings tax, lowering their united state tax liability. To receive FEIE, you need to satisfy either the Physical Presence Examination (330 days abroad) or the Authentic Residence Test (confirm your key home in an international country for an entire tax year).

The Physical Visibility Test likewise needs U.S. taxpayers to have both a foreign earnings and a foreign tax home.

The smart Trick of Feie Calculator That Nobody is Talking About

A revenue tax treaty in between the U.S. and an additional country can assist prevent double tax. While the Foreign see post Earned Income Exclusion decreases taxable revenue, a treaty may give added benefits for eligible taxpayers abroad. FBAR (Foreign Checking Account Record) is a needed declare united state residents with over $10,000 in international economic accounts.

The foreign gained income exemptions, sometimes referred to as the Sec. 911 exclusions, omit tax obligation on incomes gained from working abroad.

The Single Strategy To Use For Feie Calculator

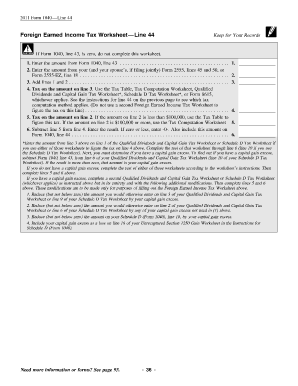

The tax benefit omits the income from tax obligation at bottom tax obligation rates. Formerly, the exemptions "came off the top" lowering revenue topic to tax obligation at the leading tax obligation rates.These exemptions do not excuse the wages from US taxation however just supply a tax obligation decrease. Keep in mind that a single individual working abroad for all of 2025 who earned concerning $145,000 without any other earnings will have taxed earnings lowered to zero - properly the very same response as being "tax obligation cost-free." The exclusions are calculated each day.

If you went to service meetings or workshops in the US while living abroad, revenue for those days can not be excluded. For United States tax obligation it does not matter where you maintain your funds - you are taxable on your around the world earnings as a United States individual.

Report this wiki page